My work on Individual Travel Requests continued this week, including some changes that are likely going to be a bit controversial. As such, please make sure to let leave a comment below to share your thoughts on this!

So…individual travel requests are just that: Rather than having just three (or four, if you count cargo) static sets of rules for how passengers rate flights, the demand on a given airport pair is split into a whole bunch of individual requests. Each such request has an individual set of preferences and aversions (among other things, but more on those in a future issue). Think of these as the weight a passenger gives to a certain attribute of a given connection, like how important good seats are to them or how much they dislike connections with a lot of stops.

And while these requests are still generated according to pre-defined “passenger types”, those passenger types merely define the ranges into which the concrete preference/aversion values will fall. When a request is generated, we pseudo-randomly pick a value from the given range. Example: While a “no-frills eco passenger” type might generally have a high price sensitivity, one request might have a slightly higher one than another.

This has two main consequences.

The first one is the one for which we’re doing this in the first place: Demand in AirlineSim will become a lot more segmented, meaning airlines won’t necessarily compete for one and the same type of passenger anymore. Instead, they can and have to specialise to some degree. Certain market segments will be larger than others, of course. And in the future, their distribution might differ from place to place. But all in all, this should make it a tad harder to just build a single, massive airline that can soak up 100% of an area’s demand.

The second consequence is the one I expect to be a bit of a hard sell to people who’ve been playing AirlineSim for the past decade or so: With individual travel requests, it becomes rather pointless to show product ratings. Every request will value each attribute of a connection in a different way whenever said connection has been generated. Therefore, the ratings we currently show on flight info pages, in scheduling or in ORS results paint a false picture.

For now, I have implemented two changes:

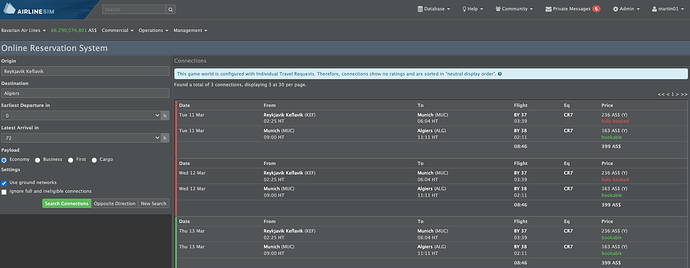

I have removed all ratings from ORS results. Instead, the results are sorted in so-called “neutral display order”, which is also how the ORS picks a subset of connections for a travel request before rating them by its individual preferences:

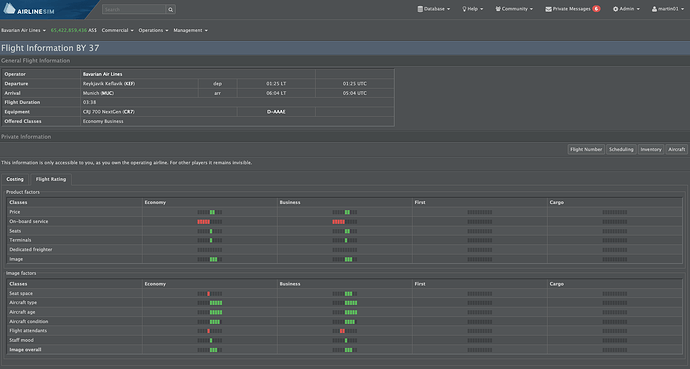

On flight info pages (and wherever we currently display detailed product rating matrices) I merely removed the totals (overall product and price performance ratio):

But technically, the latter is only a partial solution: The current ratings are based on the old rating system, which takes into account weights specific to the respective service class as well as the flight distance. The new rating system works in a completely different way, though. Short of not displaying anything at all here (as in: just drop these rating matrices altogether) the only sensible thing I can think of would be absolute product values. So as an example: “On a scale from worst seat to best seat, this is where the offered seat falls”. But I am unsure about whether this would be useful at all.

Please let me know what you think!