Several areas are currently under consideration for proposed changes due to the significant overhaul underway.

I find it difficult to comprehend the resistance to acknowledging that the existing system, while functional for some, is both highly unrealistic and demonstrably detrimental to growth. This resistance persists even though the proposed changes are still in the formative stages of development, far from acceptance.

Any realistic in-game economy, when conceived, logically necessitates the inclusion of some form of borrowing mechanism.

This borrowing capacity has been correctly categorized into unsecured and secured loans, reflecting the fact that the underlying assets for these financial instruments are the aircraft purchased. It should be noted that airport buildings, while considered assets, are ineligible for financing via secured loans.

Let me elaborate further.

Loans and other forms of business financing are fundamentally tools that drive expansion. For a company to secure a substantial unsecured loan, it typically requires a fleet exceeding 150-200 aircraft of A320/B737 size. At this scale, an airline can generate weekly profits several times the loan amount, enabling swift repayment. Subsequently, as an airline grows, its capacity to repay loans increases correspondingly. This dynamic is inherent to capitalism and is not inherently negative.

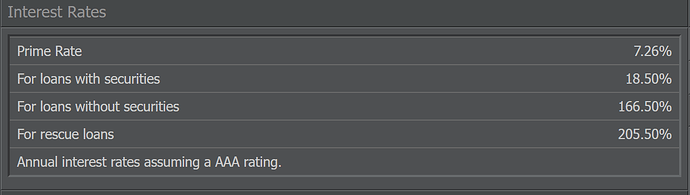

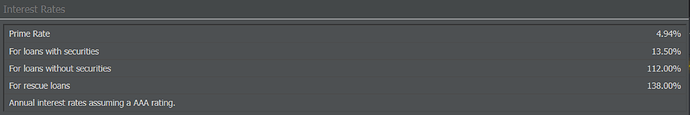

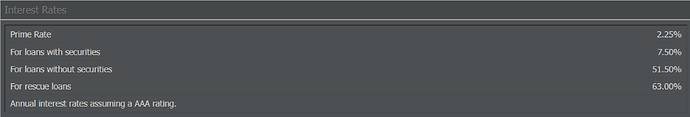

The issue, in my view, lies in the imposition of annual interest rates of 100-200% on unsecured loans, coupled with the unattractive nature of secured loans for aircraft purchases. This unattractiveness stems from the fact that the down payment for aircraft acquisition is approximately double the security deposit required for leasing. Furthermore, it is impossible to finance the purchase of a leased aircraft using the secured loan interest rate.

Given the significance of free cash flow within the game, the substantial disparity between secured and unsecured loan interest rates, as well as the spread between the prime rate and secured loan rates, is illogical and demonstrably unrealistic.

Thus, while the intent to create a more robust and realistic economic system is commendable, the current implementation of its core financial mechanisms undermines this goal. The incongruities in interest rates, down payment requirements, and financing restrictions create an artificial and ultimately detrimental barrier to organic growth within the game, especially for medium sized holdings.